24.10.2025

Poland position is growing in strength on the pet food market

The Polish pet food market is one of the fastest growing in the European Union today. The value of sales counted in billions of zlotys, dynamically growing production and the growing importance of exports make Poland one of the European and global leaders in this sector.

Market value and production in recent years have shown consistent growth in both market value and production volume. Poland, thanks to the rapid development of the pet food and treats segment, stands out from the EU average. In 2024, the value of the market reached almost PLN 5 billion , which means a growth rate of 10 percent y/y. Production increased by 21 percent compared to the previous year, and the pet treats segment increased its value by 17 percent. For comparison, the average growth rate in the EU in the pet food sector in the last decade grew by around 5% annualy. Forecasts for Poland, on the other hand, indicate that high dynamics will be maintained, with at least a 20% increase in the value of the market in the coming years.

The Polish domestic market vs the European market

In 2024, the value of the Polish internal market for pet food amounted to approximately PLN 5 billion, which corresponds to approximately EUR 1.16 billion at an average exchange rate of PLN 4.3/EUR.

For comparison, the value of the entire European market in 2023 reached EUR 29.3 billion, or about PLN 133.1 billion. This means that Poland is responsible for only 3-4 percent of the value of the EU market in terms of internal consumption.

Poland’s export position in the world

The global feed export market is estimated at over EUR 24 billion. Poland has a much stronger position on the market than on the domestic market. In 2024, the value of Polish exports of pet food amounted to approximately PLN 11 billion (approximately EUR 2.2 billion).

In 2022, Poland was the 5th exporter in the world, with a share of 7.6 per cent. At that time, Germany, Thailand, the United States and France were higher in the ranking. Two years later, in 2024, Poland moved up to 4th position, ahead of France and was already responsible for about 9 percent of global exports.

Therefore, Poland exports twice as much feed as domestic consumption, which distinguishes us from many other European Union member states.

Exports and logistical importance

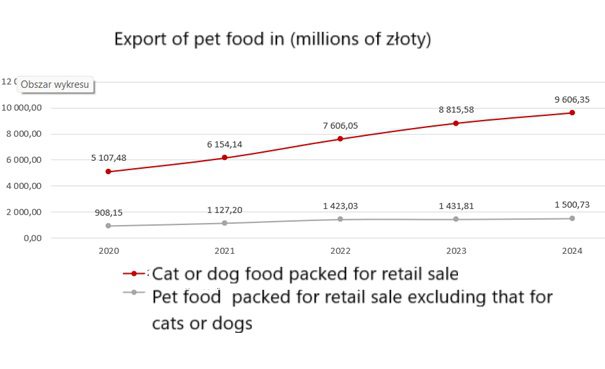

Exports of dog and cat food in 2024 reached PLN 9.6 billion , recording an increase of 9% y/y. Exports of food for other pets amounted to PLN 1.5 billion and increased by 4.8% y/y.

Source: GUS

The main export directions are primarily Europe:

- Germany (PLN 3.4 billion, an increase of 14.3 percent y/y),

- Great Britain (PLN 839.5 million, up 12.7% y/y),

- France (PLN 528.4 million, up 8.2% y/y),

- Czech Republic (PLN 469 million, down by 7.1% r/r),

- The Netherlands (PLN 379 million, an increase of 33.2 percent y/y).

- Exports to the Middle East, Asia and Africa are also growing.

Poland is becoming an increasingly important link in the global pet food supply chain. The development of infrastructure and geographical location make the country a regional logistics hub. The largest logistics base is the hub in Krakow, which provides two months of product inventory.

Investor interest

The dynamic development of the market in Poland attracts the attention of global companies. Foreign producers see potential both in domestic consumption and in Poland’s strategic role as an export centre. Investments in new and the expansion of existing production plants and logistics facilities may further strengthen our country’s position as one of the leaders of the European pet food market. In Poland, among others Nestlé Purina PetCare (Switzerland/USA), Royal Canin (France/USA), United Petfood Group (Belgium) and Josera (Germany) have invested.

Sources:

- International Trade Centre (ITC)

- World’s Top Exports (WTEx)

- Strefa Biznesu, „Polska wyrasta na światowego lidera w tej branży. Możliwe duże inwestycje”, September 2025

- Central Statistical Office (GUS)

Translated by IDC

JL

- Everything

- News (307)

- Events (173)

- Get Support (83)

-

COMEX POLSKA SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ

Minerals, metals and fuelsAluminium and articles thereofCopper and articles thereofMinerals, ores and articles thereofPrecious metalsOther metals and articles thereofIndustrial machinery and mechanical appliances and parts thereofShow allShow more Show lessComex offers innovative sorting systems and pulverizing technologies. We create sorting systems for mines, processing plants, chemical plants, and recycling plants that optimize production costs and increase the profitability of production processes by improving the quality of the final product. We utilize X-ray transmission (XRT) systems and AI to identify subtle differences in materials, enabling the effective separation of even the smallest, valuable particles.

MB AI SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ

Show more Show lessMB AI is an international medtech company developing AI solutions for healthcare. Its portfolio includes AI Agents for chronic disease management, a Clinical Support Platform optimizing medical resources, personalization modules for patient experiences, and Medbase for automated staff scheduling. All solutions integrate with existing healthcare IT infrastructure and digital platforms, enhancing patient outcomes and operational efficiency.

TOMGAST SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ

Show more Show lessTomgast is a leading Polish manufacturer and distributor of professional HoReCa equipment with 30 years of experience. Based in Łódź, we specialize in kitchenware, buffet systems, and tableware through our brands: Tomgast, Caterware, and Verlo. We focus on innovation, quality, and durability. With 48h dispatch and no MOQ, we provide comprehensive support to our global partners, ensuring efficient cooperation and top-tier products for the demanding hospitality sector.

MINDATEQ SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ

IT and TelecommunicationShow allShow more Show lessStorymode is a game development studio working in both co-development and original IP production. The studio partners with teams and publishers to support PC and mobile projects across gameplay programming, systems design, and prototyping. In parallel, Storymode develops its own narrative-driven games, applying production expertise and an iterative, product-focused approach to create high-quality, commercially sustainable titles

-

Article

ArticlePoland at the forefront of the European Digital Resilience Index (EDRIX)

The strategic position of countries in the digital dimension

Article

ArticleThe Polish clothing industry against the background of global markets

Analysis and prospects until 2029

-

Event

EventSolar Energy Expo 2026

Solar Energy Expo is Poland’s largest renewable energy industry trade fair

Event

EventPolish Logistics Day

The Embassy of the Republic of Poland in Prague cordially invites you to participate in the “Polish …

-

Institution

InstitutionThe Investor Tax Service Center

The Investor Tax Service Center is a unit operating within the Ministry of Finance

Institution

InstitutionPolish Investment and Trade Agency (PAIH)

The Polish Investment and Trade Agency (PAIH) is the partner of first-resort for entrepreneurs when …

The Export Promotion Portal uses cookies to make it easier for users to use the website and for statistical purposes. If you do not block these files, you agree to their use and saving in the memory of your computer or other device. Remember that you can change your browser settings to block the storage of cookies. More information can be found in Privacy Policy and Terms and conditions.