Why you should invest in Poland?

Poland is one of the economically most stable and fastest growing countries in Europe. It is a member of the European Union, OECD and also of G20 countries.

According to the Polish Investment and Trade Agency (PAIH), Poland at the end of 2020 was ranked as the third preferred location in Europe for foreign investments. In 2020, it had nearly 200 foreign investments for a total value of EUR 10 billion.

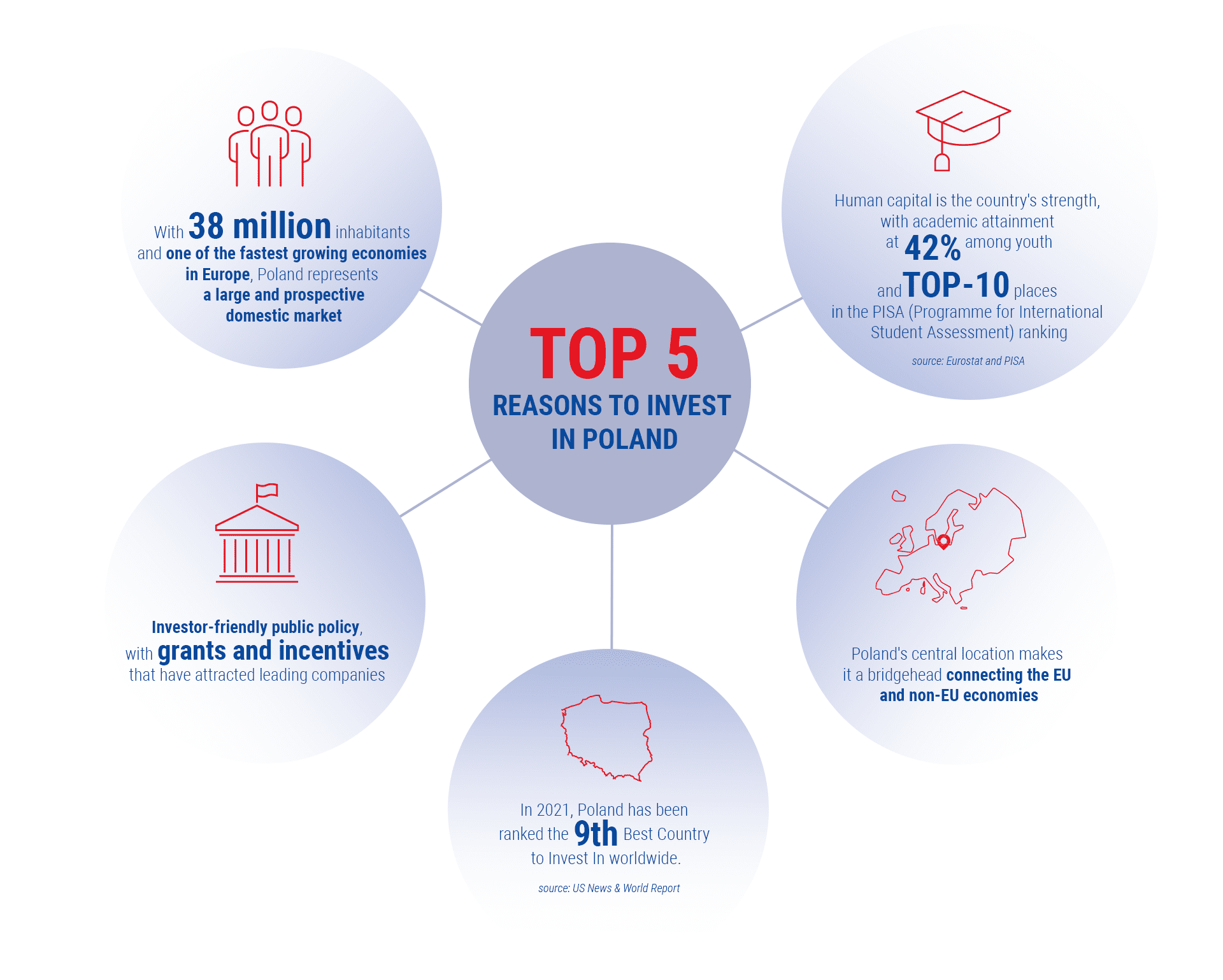

Companies choose Poland because of its sound institutional system and stable political environment, strong human capital, central location, large domestic market (the largest in Central-Eastern Europe), and investment-friendly policy, which includes a system of incentives available for foreign investors. In fact, the newest OECD report ranks Poland as a country with the fifth-lowest effective tax rate for innovative companies in the EU. The World Bank Group places Poland at the 40th position overall in its “Doing Business 2020”, higher than most of the other CEE countries and at the very first place in the “Transport across borders” category. A vast majority (94 percent) of investors who responded to the “Investment Climate” survey for 2019 (available in Polish), carried out by PAIH, Grant Thornton and HSBC, declare they are glad they have invested in Poland and would do it again.

Poland has a strong position on the list of business-friendly places. Revenues earned by foreign investors in Poland have been continuously rising. According to the newest KPMG report, they exceeded EUR 19 billion in 2020, more than twice the figure recorded a decade ago. In 2020, the United Nations Conference on Trade and Development ranked Poland the second in Europe and fifth globally in terms of the value of greenfield investment: USD 24.3 billion.

Why you should invest in Poland?

Basic information about the country

With almost 38 million citizens, Poland is the largest Central-Eastern European country. It shares its borders with 7 other countries (moving counter-clockwise: Germany, Czechia, Slovakia, Ukraine, Belarus, Lithuania, Russia) and the Baltic Sea. Its official name is the Republic of Poland.

The largest city of Poland is its capital Warsaw, which also serves as the financial and business hub of this part of Europe. Other major cities include Kraków, Łódź, Wrocław, Poznań, Gdańsk, and Szczecin as well as Silesian conurbation centred around Katowice.

Poland is a unitary state: except for very specific local regulations, the same legal regulations apply in the whole country. Poland is a member state of many international organisations, such as the European Union, World Trade Organisation, United Nations and Organisation for Economic Cooperation and Development. It was a founding member of the United Nations in 1945 and since 1997 is also a member of the North Atlantic Treaty Organization.

Economic environment and infrastructure

Poland has a strong domestic market, low private debt, and one of the lowest unemployment rates in the European Union. It has its own, free-floating currency, the złoty (1 PLN ≈ 0.24 USD)[1]. The economy is diversified and not dependent on any single export sector. The rating agencies Fitch and Standard & Poor’s rate Poland at A- with a stable outlook.

In 2020, Polish GDP (measured by the purchasing power parity) totalled USD 1,363 trillion, which, according to the World Bank, ranked the country as the 19th largest economy in the world. The Rating agency Standard & Poor’s predicts that Polish GDP will expand by 3.6% this year. The European Commission is even more optimistic, estimating the GDP growth rate to reach 5.5% in 2022, which would place Poland among the fastest-growing countries on the continent.

Poland, due to its strategic, central location in Europe, is an important transport hub. Seaports are located all along Poland’s Baltic coast. Most freight operations use harbours in Świnoujście, Szczecin, Gdynia and Gdańsk. Over the past years, the country has also accomplished a major overhaul of its road and railroad network, and further improvements are in progress

Poland also has a well-developed digital infrastructure and office landscape. Knowledge of English at a professional working proficiency is customary for the office workforce.

European Union and its single market

Poland is a member state of the European Union (EU) and part of the EU single market. As a result, investing in Poland means that you gain access to a 446-million-consumer market for your company.

The EU member states share a single market, a single external economic border, and a single external trade policy within the World Trade Organisation (WTO), where the rules of international trade are negotiated and enforced. The EU is deeply integrated with other global markets. It maintains an open trade regime and protects intellectual property rights.

Investors will also benefit from the fact that Poland is a part of the Schengen Area. Within the Area, EU citizens as well as non-EU citizens (as long as their stay is legalised) can move freely without border controls. It makes doing business easier for investors, employees, and contractors, and it facilitates cross-border trade.

Furthermore, Poland is a member state of the European Economic Area (the EEA). This zone consists of the member states of the European Union and three countries of the European Free Trade Association (EFTA) – Iceland, Liechtenstein, and Norway. The Agreement on the EEA seeks to strengthen trade and economic relations between the contracting parties. It allows for free movement of goods, services, and capital between the member states. This means that Poland connects the perfect environment for production process, good infrastructure and access to Western customer base.

What to invest in?

Almost all market sectors in Poland are open for business and offer attractive investment opportunities. These include services, manufacturing, food and agriculture, high-tech and specialised industries – all these market sectors in Poland are open for business and offer attractive investment opportunities, too. In some cases, special requirements on safety and quality may apply, for instance periodical control of safety of food production and processing. For certain types of activities, such as mining, trading of fossil and fuels or public transport, licences are needed. Polish companies benefit not only from the growing wealth of the domestic consumers: they are also the 20th largest exporter of goods and services in the world.

The public sector also offers investment opportunities. All public procurement above a certain threshold is required to be organised by way of public tenders. As a result, companies from the entire EU can bid on the same terms as the Polish ones for large and small projects, whether for delivery of goods or services. Any procurements of the value above PLN 130 000 (c.a. EUR 30 000) are published at this link Procurements above the following thresholds: EUR 139 000 for most services and deliveries, EUR 428 000 for the energy production and transport, and EUR 5 350 000 for construction works must be published here.

Furthermore, various forms of private-public cooperation can be established for the provision of communal services (e.g. waste collection, energy supply, parks and recreation services), often offering compelling investment opportunities.

When it comes to financial investment, Poland is home to the largest stock exchange in the region (by capitalisation), that is the Warsaw Stock Exchange (Giełda Papierów Wartościowych). The Warsaw Stock Exchange operates 3 markets and 3000 instruments. The private equity sector is also promising and attracting investors. Many Polish household-name brands, like convenience stores, food or cosmetics producers became successful investments for foreign funds and companies. Some of the notable examples are Żabka, a convenience store chain, Star Foods, a snack producer, and Bielenda and Dermika, beauty products companies.

Incentives for investors

As a form of supporting investment, Poland has developed a system that includes tax reliefs and grants, which are financed from the European Union’s funds as well as from domestic sources. In the following sections, you can find a guide on the most important types of support for investors in Poland.

Special Economic Zones

Companies that invest in Poland can benefit from CIT exemption for business activities conducted within the Polish Investment Zone. In geographical terms the Zone covers the whole country, however in terms of governance it is divided into fourteen Special Economic Zones (SEZs), managed by separate entities. The full list of the SEZs, as well as detailed information on Polish Investment Zone can be found at this link.

SEZs are located in selected parts of Poland. In these micro-regions, companies can operate on preferential terms and conditions. This type of support shall be available until the end of 2026.

The amount of support is calculated depending on the location of investment and its costs or the number of new jobs created.

Polish investment zone act on support for new investments – regional aid for new investments

Since 2018, many new investments in Poland are eligible for special regional aid. It applies to new enterprises, capacity increases, and production diversification projects.

The aid takes the form of tax (PIT or CIT) exemption. It is addressed to enterprises in the following sectors: heavy industry (with some exceptions), wholesale and retail trade, construction works, services related to accommodation and catering services, and video games developers. The list also includes selected enterprises from the business services sector, for instance IT, R&D, auditing and bookkeeping, accounting and call centres.

The maximum amount of public aid in the form of CIT or PIT tax exemption is different in the various parts of the country and currently ranges from 10% in Warsaw to 50% in four eastern voivodeships: Warmian-Masurian, Podlaskie, Lublin, and Subcarpathian. Support for medium and small or micro enterprises is increased by 10 and 20 percentage points respectively (e.g. 25% becomes 35% or 45% respectively).

Government grants

Government grants are provided for investments of significant importance to the Polish economy. The plan will last until 2030. Grants are based on an agreement concluded between the Ministry responsible for the economy and the investor. The agreement lays down the conditions for the grant’s payout, which is disbursed proportionately to the degree that the investor’s commitments are fulfilled.

Under the Programme, support for initial investment will be granted based on eligible costs for creating new jobs and eligible costs of investments. The amount of the grant may be increased if training programmes are offered to employees. The Programme is financed entirely from domestic funds.

Cash grants from EU funds

In the case of companies registered in Poland, cash grants from EU funds can be obtained for R&D. They cover innovative new investments, energy efficiency projects, and production of energy from renewable sources.

State aid and tax relief for research and development

Did you know that according to the OECD calculations, Poland offers the fifth most generous tax incentives for innovative companies in the EU? R&D projects in the following areas are eligible for the state aid and tax reliefs:

- Basic research

- Industrial research

- Experimental development

- Feasibility studies

- R&D infrastructure development (such as requires setting up or developing an R&D centre)

The eligible expenses may include wages and salaries, costs of building, land, instruments, equipment, and intellectual property rights as well as indirect costs related to the project and its management.

Furthermore, entrepreneurs who operate in the area of research and development (except for those who benefit from a Special Economic Zone) may benefit from an income tax relief. The following costs related to R&D works may be additionally deducted from the tax base:

- Gross wages and compulsory contributions of R&D employees

- Cost of materials and resources directly related to R&D activities

- Cost of expertise, opinions, advisory and other equivalent services as well as costs associated with the acquisition of R&D results provided or performed by scientific institutions

- Costs of use of R&D equipment dedicated exclusively to R&D activities

- Depreciation write-offs of tangible and intangible assets used for R&D activities

Small and medium entrepreneurs may additionally deduct the costs of obtaining a patent for an invention.

Real-Estate Tax (RETAX) exemption for new investment projects

Some municipalities offer support in the form of real estate tax exemption (RETAX). It applies to land, buildings, and other infrastructural constructions that are related to a new investment. These must be located within the area of the council.

Industrial and Technology Parks

Industrial and technology parks are centres whose mission is to support development of companies. The facilities offered are applicable both to Polish and foreign businesses. Every centre of this kind has its own specific orientation, depending on economic factors and different forms of capital available in the region. In general, entrepreneurs are offered services in the form of:

- Consultancy

- Transfer of technology

- Transfer of the results from scientific research and development work

- Favourable conditions for businesses

The facilities for entrepreneurs operating in these technological parks can include tax exemptions (CIT, property tax), preferential lease and utilities prices as well as free or inexpensive access to office or laboratory facilities.

People in Poland

Human Capital

Human capital is among the country’s strongest assets. Academic-level education is prevalent: in 2020, the percentage of people aged between 25 and 34 who graduated from higher education was 42.4%. Polish teenagers regularly place in the top 10 of the PISA ranking, the world’s most comprehensive study of 15-year-old students’ scholastic performance in mathematics, science, and reading.

Part-time degree courses as well as professional and postgraduate trainings are relatively inexpensive, accessible, and popular among professionals. This makes developing back offices tailored to your needs easier and more cost-effective than in many Western countries.

One profession Poland is particularly well-known in the world for is its IT crowd. Polish programmers, graphic designers, and IT technicians have grown to become a world-wide known brand, as testified by a large number of Polish brands in the video game industry. Moreover, e-commerce is growing much faster in Poland than in many other EU countries, according to 300Research and ImpactCEE. According to the newest Santander Bank data, the sector grew by 30% in 2021, and the growth rate is expected to reach up to 40% in the next 10 years.

International companies frequently choose Poland as the location of their back offices or outsourcing services. Labour force in Poland is highly qualified. At least 40% of Polish citizens know at least one foreign language. Therefore, business service centres (BSC) are widespread in major Polish cities. Kraków, the second-biggest city in Poland, is the leader in terms of employment in this sector, with nearly every fourth person employed in the BSC’s in Poland working in Kraków.

Whether you think about outsourcing your accounting, HR or customer service activities, you should consider Poland. Especially for the European companies, none or minimal time zone difference could also be a strong advantage.

Consumers

Demographics

According to the 2021 census, Poland had a population of over 38.1 million. Its population has been ethnically homogeneous for many years. However, this situation is now changing, with a considerable migration influx. The number of migrant workers, according to official statistics, is estimated to be as big as 1.27 million. A large part of them comes from Ukraine. According to the public Social Security Institution data, there are 850 000 legal residents of Ukrainian nationality living in Poland. There is also a big inflow of immigrants from Belarus. But smaller groups of people come to Poland from all around the world. The market is of course responding and the range of services dedicated specifically to migrants is emerging.

Population density is higher in the southern area around Kraków and Katowice and in the central area around Warsaw and Łódz, with an extension to the northern coastal city of Gdańsk.

In 2018, the average life expectancy was 77.9 years (74.1 for men and 82 for women). Like many most developed nations, the Polish population is ageing. In 1950, the median age was 25.8, while today it is 38.2. If current trends continue, it may reach 51 by 2050.

There is a very strong Polish diaspora around the world. In 2015, it was estimated that around 2.4 mln Polish citizens lived abroad at least for a while, most of them in Europe. Among the EU countries, the largest number of people remained in the United Kingdom (720,000), Germany (655,000), the Netherlands (112,000), Ireland (111,000), and Italy (94,000). A strong Polish minority is present in the territories of contemporary western Ukraine and Belarus, eastern Lithuania, eastern and central Latvia, and northeastern Czech Republic.

Income level and lifestyle

As of 2020, 60% of the Polish population lives in urban areas. This number is slowly decreasing, as people are moving to suburban and rural areas. However, the percentage of people working in agriculture is decreasing as well. At the same time, the majority of the biggest cities in Poland record growth of their population, too.

This means that the current trend is to move to a metropolis or suburbs, rather than live in a mid-size town. As in many countries, it reflects both the lifestyle changes and the income differences.

In 2019, the level of the average monthly disposable income per person, rounded to PLN 1, was PLN 1,819 (around 400 EUR or 475 USD). The average monthly expenditure per capita in households in 2019 amounted to 1,252 PLN. Expenses on consumer goods and services amounted to PLN 1201.

As per the OECD data, the yearly average net disposable household income in 2020 was around USD 24,220 (gross adjusted value). This ranks Poland as number 27 on the OECD list, above such countries of the CEE region as Russia and Hungary.

The demand for inexpensive goods and services in Poland is very high. Both chain and local retailers that offer low cost products, frequently used or imported from Asia, are very popular. However, the overall economic level of the population is growing. It is also true when it comes to the wealthiest part of the population. It has been estimated that the number of millionaires in Poland will be growing at the fastest pace in the world in the next few years. Therefore, the luxury goods market is bound to expand as well.

It is also worth to notice, that Poland is an excellent test-market for technological innovations. As surveys and studies on consumer engagement and attitudes show, the Polish population has much more early adopters than average 13.5%. According to A. Jasiulewicz and M. Lemanowicz study from 2016, there are more than one third of early adopters among Polish citizens, especially in young generations.

Spis treściTable of contents