Poland’s electronics exports

21.05.2025

Although 2024 did not bring any breakthroughs, the electronics sector in Poland is not losing momentum. Companies are investing in modern technologies and looking for new markets. Electronics exports have a chance to rebound in the coming months.

The value of retail sales of consumer electronics in Poland – including audio/video equipment, household appliances and mobile devices – amounted to over PLN 44 billion in 2024. The increase was symbolic, only 0.3 percent year-on-year. However, the sector did not experience a slump, but rather adapted to the new economic realities – high inflation, rising production costs and shifts in consumer demand

The slowdown also affected foreign trade. According to the Polish Central Statistical Office, the value of total exports from Poland in 2024 fell by 0.8 percent compared to the previous year. Our largest trading partner, Germany, imported 5.6 percent less from us than in the previous year.

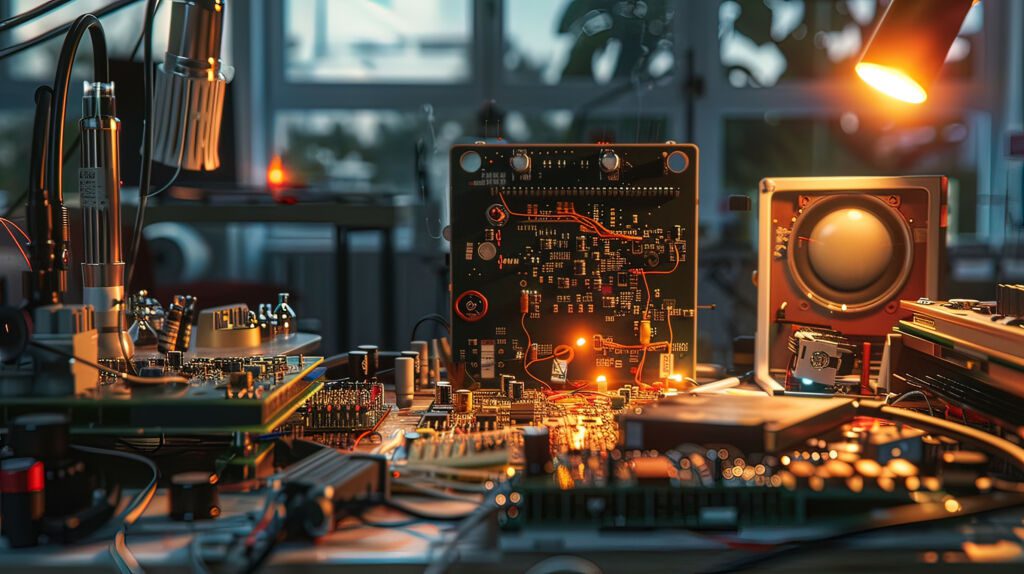

Export of electronics: more advanced technologies

Despite the general decline, electronics exports have not lost their importance – on the contrary, the share of high-tech products in the export structure is growing. In 2023, the value of exports in this category reached EUR 33.8 billion, which means an increase of 6.8 percent compared to the previous year and accounted for 9.6 percent of Poland’s total exports.

Between stagnation and modernization

According to the data contained in the report by the Progres Group, the Polish electronics sector currently employs about 63,700 people. Despite the decline in orders, companies are not significantly reducing employment. Instead, they are investing in automating and digitizing processes – from quality control to AI-powered customer service.

The future of the sector is clearly moving towards digital transformation. According to the European Commission’s report, Poland plans to allocate as much as EUR 12.4 billion (or 1.6 percent of our GDP) in 2024-2025 for the development of digital infrastructure, including 5G networks and support for the professional electronics industry.

Bottlenecks: HR and supply chains

One of the main challenges faced by electronics exports remains the availability of qualified employees. The problem affects both engineers and production line operators – especially in regions with low unemployment. In 2024, companies from this industry reported difficulties in filling positions such as service technicians, quality controllers and test engineers.

At the same time, companies are struggling with disruptions in logistics. Extended transport times (by up to two weeks) and rising container prices are the result of conflicts in the Red Sea region and geopolitical tensions. This directly affects the ability to fulfil export orders on time.

New requirements: ESG and environmental responsibility

More and more companies in the electronics industry today operate in a regulatory environment that enforces not only technological innovation, but also social responsibility. ESG (environmental, social, governance) requirements are becoming a real criterion for assessing a business partner on the European market.

Many companies implement supplier audit procedures, counteract exclusions in production teams and try to reduce the impact of their operations on the environment – for example by investing in recycling and industrial filters. These solutions are not yet common, but the requirements of large customers (e.g. in the automotive industry) mean that Polish entities must also adapt to them.

Export of electronics and the SME sector

Although the electronics sector is mainly associated with large corporations, small and medium-sized enterprises in Poland also play an important role in exports. Data from the report of the Polish Agency for Enterprise Development (PARP) on the professional electronics sector indicate that SMEs are responsible for a significant part of the implementation of innovative solutions in industrial, medical and defence electronics.

Smaller companies often specialize in niche products: measurement systems, control and measurement systems, control modules or electronics used in industrial automation. As a result, they are more flexible, implement changes faster and adapt more easily to the changing market environment.

Time for new markets and new strategies

The year 2025 could be a turning point. Market experts expect a recovery in consumer demand and new investments in the domestic high-tech industry. More and more Polish companies are exploring the possibilities of exporting electronics to non-European markets – to Central Asia, the Persian Gulf countries or Sub-Saharan Africa, where the demand for industrial equipment and electronic components is constantly growing.

The EU’s “open strategic autonomy” (OSA), which promotes the shortening of supply chains and the relocation of production to member states, is also conducive to strengthening the position of Polish exports. Poland, with its good infrastructure, skilled workers and experience, has a chance for long-term growth.

Sources:

- PMR Market Experts – Poland’s electronics market: stabilisation in 2024 and hopes for dynamic growth in 2025

- The Polish Chamber of Commerce (KIG) – Polish exports in numbers – analysis of the latest data

- The Polish Development Fund (PFR) – Polish Innovation – October 2024

- The Polish Agency for Enterprise Development (PARP) – Professional electronics, microelectronics and photonics sector in Poland

- CRN Polska – PLN 22 billion of Polish electronics exports

- Komisja Europejska (European Commission) – Digital Decade Country Report: Poland 2024

- Asselems – Electronics Manufacturing Industry Trends for 2024

- Grupa Progres – Report 360. Electronic Market in Poland

- Everything

- News (325)

- Events (182)

- Get Support (83)

-

TEAM GRONO Spółka Z o.o.

Show more Show lessOver 25 years of experience in manufacturing, sales, repair and regeneration of diesel fuel equipment. Our team consists of professionals and industry experts. We deal with manufacturing and regeneration of fuel equipment of diesel. Each order is treated individually and our actions always ends with success. Our work we solidly and satisfa

CHIPCRAFT SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ

Show more Show lessChipCraft is a private fabless semiconductor manufacturer that specializes in GNSS technology. The company provides fully integrated, all-band, all-constellation GNSS receivers of high precision and reliability. The NaviSoC receiver is offered as a chip and as a module, and is dedicated to consumer, industrial and automotive markets. ChipCraft also offers custom silicon design and development services for ASIC and FPGA, as well as silicon-proven IP blocks and IP cores, for multimarket sectors.

VIMAX FLAVOURS & INGREDIENTS SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ

Alcoholic and non-alcoholic beveragesDairy productsFruit, vegetables, mushrooms and products thereofPrepared meat and sausagesBaked goods and sugar confectioneryCereals and products of the milling industryOther food productsShow allShow more Show lessWe are one of the biggest polish flavour houses. For over 35 years VIMAX has been appealing to the human senses by creating original compositions of flavouring products. We offer over 4,000 products. Continuous development and a wide range of flavouring preparations based on our own know-how have earned our company a place at the forefront of domestic producers of food additives. We manufacture our products in accordance with the FSSC 22000 certificate.

"ALIVE" SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ

VehiclesAutomotive industryCombustion engines, motors and parts thereofLocomotives, rolling stock, special vehicles and parts thereofElectric engines and batteriesAerospace industryTiresVehicle parts (excluding engines)Show allShow more Show lessAliff is a Polish company specializing in the design and production of special vehicle bodies, mobile modules, and dual-use solutions for defence, civil protection, and critical infrastructure sectors. We focus on pickup conversions, modular systems, power integration, and advanced technologies, combining strong manufacturing experience with modern engineering and operational design.

-

Event

EventXXXI International Fair PETROL STATION 2026

The International Fair PETROL STATION 2026 will take place on 13–15 May 2026 at EXPO XXI, Warsaw, Po…

Event

EventEast x West Forum 2026

East x West Forum 2026 will take place in April 2026 in Wrocław, Poland

-

Institution

InstitutionThe Investor Tax Service Center

The Investor Tax Service Center is a unit operating within the Ministry of Finance

Institution

InstitutionPolish Investment and Trade Agency (PAIH)

The Polish Investment and Trade Agency (PAIH) is the partner of first-resort for entrepreneurs when …

The Export Promotion Portal uses cookies to make it easier for users to use the website and for statistical purposes. If you do not block these files, you agree to their use and saving in the memory of your computer or other device. Remember that you can change your browser settings to block the storage of cookies. More information can be found in Privacy Policy and Terms and conditions.