Aviation & Aerospace Industry

16.01.2026

Current information

Industry description

Over the past sixty years, space has played a pivotal role in advancing global science, technology and innovation. It is a strategically important sector for humanity and governments, offering a wide range of economic, social, geopolitical, defence and environmental benefits.

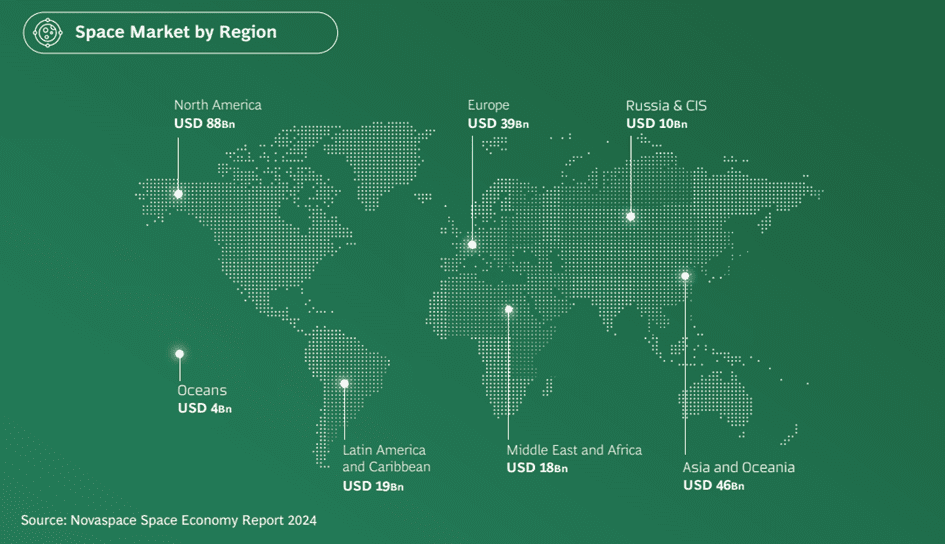

The space economy, which encompasses all economic activities and value creation driven by space-related technologies and systems, is expected to grow from USD 596 billion in 2024 to USD 944 billion by 2033. This growth is mainly due to the development of services such as satellite communications and Earth observation.

According to Novaspace analyses, Europe is the third-largest space market in the world, valued at USD 39 billion in 2024.

The European Space Agency (ESA) strengthens the entire space-related industrial value chain in Europe. The agency’s investments cover everything from research and development to the production and launch of space systems.

For every euro invested in ESA programmes, up to four euros are generated in economic returns, while attracting 2.8 euros in third-party investments. The ESA’s work provides essential public services, including climate monitoring and urban development, and demonstrates how space activities contribute to long-term socio-economic value.

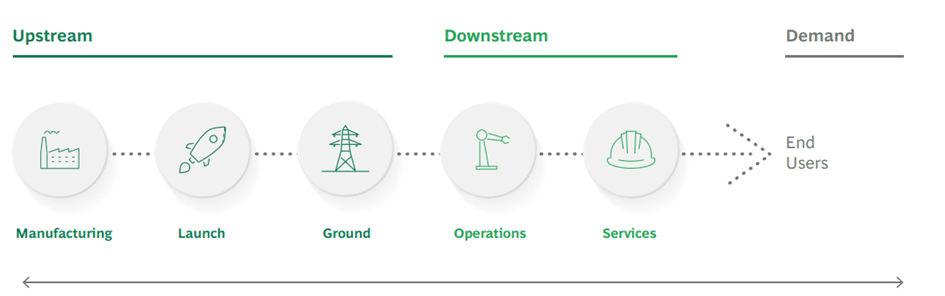

The space market is typically divided into two areas: upstream and downstream.

For all countries conducting space research, expanding scientific knowledge and technological capabilities are key factors. Additionally, commercial potential and security are becoming increasingly important motivators.

The Space Sector in Poland

Poland’s space sector is a key area for developing innovative, high-value technologies. Developing domestic satellite, observational and propulsion technologies increases Poland’s competitiveness on the international stage, enabling it to participate actively in the global space services market.

The Polish Space Strategy, adopted in 2017, aims for the Polish industry to achieve a 3% share in the European space market by 2030. The use of space technologies — including navigation systems (Galileo), Earth observation (Copernicus), and satellite communications — supports the economy on many levels.

Sector Data

- 566 enterprises and research institutions registered in ESA’s STAR system, including 125 SMEs

- Polish entrepreneurs have secured contracts from ESA worth over €270 million

- Poland participates in 11 of the 24 ESA missions

- In 2025, the CAMILA Programme was signed and is being financed under the MRiT-ESA agreement, which was concluded in 2023. The programme’s objective is to develop a constellation of Earth observation satellites, thereby enhancing Poland’s access to satellite data and fostering the growth of its national Earth observation capabilities. The constellation will consist of optical satellites and one radar satellite. This constitutes a notable contribution by both the European Space Agency and the Polish government towards the goals outlined in the White Paper on European Defence Readiness in 2030. The White Paper on Defence, presented on 19 March 2025, addresses issues relating to defence capabilities, industrial competitiveness, investment needs, skills, and partnerships.

Supporting Institutions

Polish Space Agency (POLSA) – an executive agency of the Ministry of Development and Technology, established in 2014. POLSA’s tasks include:

Supporting the development and promotion of the potential of enterprises and research institutes in the national space sector

- Coordinating the activities of the Polish space sector at national and international levels

- Promoting the use of satellite technologies in public administration

- Participating in projects that strengthen national defense capabilities

- Representing Poland in contacts with international space organizations

Polish Space Industry Employers’ Association – a sectoral organization that supports the business activities of its members. It consolidates entrepreneurs, research centers, and other space sector organizations, fostering cooperation between science and business.

Contact: https://space.biz.pl/home/ | Email: biuro@space.biz.pl

Association of Polish Space Industry Entrepreneurs (ZPPPK) – a sectoral organization that serves as a cooperation forum, supports sector development, and represents companies operating in space technologies. Established in 2025.

Contact: https://zpppk.pl/ | Email: biuro@zpppk.pl

Polish Space Professionals Association (PSPA) – builds networks among Polish professionals working in the domestic and international space sector.

Contact: https://pspa.pl/

Supporting the development and promotion of the potential of enterprises and research institutes in the national space sector

- Coordinating the activities of the Polish space sector at national and international levels

- Promoting the use of satellite technologies in public administration

- Participating in projects that strengthen national defense capabilities

- Representing Poland in contacts with international space organizations

Flagship Products of the Polish Space Sector – examples

EagleEye Satellite – an Earth observation satellite with ~1m resolution, developed by a consortium including: Creotech Instruments S.A. (lead partner), Scanway Sp. z o.o., and the Space Research Centre of the Polish Academy of Sciences (scientific partner)

Scanway Optical Payload (SOP) – a line of satellite cameras for various remote sensing applications. Compatible with nano/microsatellites, it offers multispectral imaging (RGB/PAN/NIR/SWIR) with ground sample distance (GSD) ranging from 1 to 25 metres per pixel.

CoreSight by N7Space – hardware technology in modern ARM-based SoCs, that enables non-invasive program and system event tracking

Perseus – space traffic management observation system by Sybilla Technologies

Leopard by KP Labs – a compact data processing unit (DPU) for micro/minisatellites, offering onboard AI-powered data analysis

HUSSAR by Space Forest – advanced SAR radar solutions for UAVs, drones, and manned aircraft

EYCORE SAR Sensor – the world’s first SAR radar sensor ready for satellite integration

HyperSat Platform – a modular microsatellite platform designed for flexibility and adaptability, built by Creotech Instruments

Launch Adapter Ring Gripper – a robotic gripper for satellite servicing by PIAP SPACE

Solar Panel Deployment System – a spring-driven, fully mechanical system for small/medium satellites, activated by Astronika’s 16kN HDRA device

Eco-friendly Bipropellant Engine (10–20 N thrust) – developed by the Łukasiewicz Research Network – Institute of Aviation

Cloud Services by CloudFerro – e.g., the CREODIAS platform for accessing and processing Earth Observation (EO) data and enabling scalable EO-based services

Aviation sector

Poland’s aviation sector is an advanced, export-oriented and innovation-driven industry with significant economic importance. The sector’s heritage dates back to the interwar period and the establishment in 1928 of Państwowe Zakłady Lotnicze (PZL) in Warsaw, which laid the foundations for today’s industrial ecosystem.The aviation sector in Poland comprises over 100 entities, including global manufacturers as well as dozens of micro, small and medium-sized enterprises (SMEs). The sector involves more than 32,000 employees and generates an annual output of PLN 14.5 billion.

Polish companies operate across the entire aviation value chain, from designing, manufacturing, Research and Development (R&D), to Maintenance, Repair, and Operations services (MRO). Machining and fabrication capability is supported by forge shops, aluminum and precision casting facilities, special processes companies, raw materials distributors and university laboratories (e.g. Research and Development Laboratory for Aerospace Materials of the Rzeszow University of Technology). This allows production in Poland:

- aircraft structures, turbine blades, landing gear components, propulsion modules,

- full aircraft production (e.g., S-70i Black Hawk, M28 aircraft, SW-4, W-3PL Głuszec, AW149 helicopters),

- advanced R&D in propulsion, materials, simulation, and UAV technology.

Thanks to long-standing industrial cooperation, most major global OEMs maintain manufacturing or engineering centres in Poland. Examples include:

- Pratt & Whitney which is a division of Raytheon Technologies Corporation (RTX): engine modules, engineering and testing, R&D activities,

- GE Aerospace: engineering design of aircraft propulsion and composite airframe structures, turbine blade production, certification activities, repair and service,

- Boeing: engineering design, software engineering and avionics center, distribution services,

- Collins Aerospace which is a division of Raytheon Technologies Corporation (RTX): parts and subassemblies for landing gear,

- MTU Aero Engines Polska: engine parts e.g. low-pressure turbine blades and vanes, seals, discs,

- Safran Transmission Systems Poland: parts and complete power transmissions systems,

- Airbus: aerostructures and R&D activities,

- PZL Mielec a Lockheed Martin Company: production of parts and complete aircraft.

Advanced technologies at disposal of aviation companies in Poland allowed them to be part of the aircraft programs like e.g. Boeing 787 Dreamliner, Airbus 320 NEO, Bombardier C Series, F 35 as well as new generation of engines like GTF PW 1000 or CFM 56 Leap.

Sector Data

- Over 100 companies, including global manufacturers and SMEs, with many more related,

The total sector revenue in 2022 reached PLN 14.5 billion,

Over 32,000 employees,

Every PLN 1 million of value added generated in aviation brings PLN 1.8 million of value added in the wider economy.

Supporting Institutions

The Association of Polish Aviation Industry represents the aeronautics, space, defence and security industries in all matters of common interest with the objective of promoting and supporting the competitive development of the sector in Poland. APAI currently gathers 27 companies and institutions with the total number of 13,000 employees.

Contact: http://www.sppl.org.pl/en/apai-aims/ | Email: info@apai.pl

The Aviation Valley Association is the largest aviation cluster in this part of Europe. The cluster brings together aviation-related stakeholders located in the southeastern part of Poland. The cluster was established to improve and grow the aerospace industry by creating a strong network of companies, developing a competitive-cost supply chain, and fostering cooperation with universities and research centers. Aviation Valley currently gathers 194 companies and institutions with the total number of 35,000 employees.

Contact: https://www.dolinalotnicza.pl/en/contact/ | Email: info@dolinalotnicza.pl

The Silesian Aviation Cluste was established by aviation industry representatives to foster cooperation between businesses, create optimum conditions for continuous transfer of knowledge and innovative solutions between the Cluster members, not only from the aviation sector but also from other branches of science and industry.

Contact: https://en.aerosilesia.eu/ | Email: biuro@aerosilesia.eu

The Association of Entrepreneurs of Aviation Industry “Wielkopolska Aerospace Cluster” is a cluster, which bringings together representatives of companies involved in activities to improve the competitiveness of the aviation industry in wielkopolskie region.

Contact: https://www.wkl.org.pl/en/268-history-of-our-cluster.html | Email: biuro@wkl.org.pl

The Lublin Cluster of Advanced Aviation Technologies – the aim of the cluster is to create an organization bringing together enterprises, universities and other entities operating in the region to develop the aviation sector based on advanced technologies.

Contact: https://www.lkl.lublin.pl/ | Email: lkl@park.swidnik.pl

Flagship products of the Polish Aviation Sector – examples

S70i Black Hawk from PZL Mielec a Sicorsky company, is a medium, multi-role military helicopter designed for a wide range of missions including troop and cargo transport, search and rescue, casualty evacuation, border patrol and special operations.

- SW-4 from PZL Świdnik a Leonardo Helicopters company, is a multi-purpose, light single engine helicopter with excellent performance, flight envelope and cabin space. The helicopter can carry up to five persons including pilot(s).

- W-3A Sokół from PZL Świdnik, is a robust and reliable medium-size, twin-engine helicopter, developed to provide the perfect solution for the most challenging missions.

- AW149 from PZL Świdnik, is a medium, multi-role military helicopter designed for a wide range of missions including troop and cargo transport, search and rescue, casualty evacuation, border patrol and special operations.

- M28 aircraft from Polskie Zakłady Lotnicze w Mielcu, is a twin-engine turboprop aircraft designed for multi-role utility missions, known for its short take-off and landing (STOL) capabilities from unprepared surfaces like e.g. grass.

- HAASTA multiplatform UAV system from EUROTECH Sp. z o. o., is an unmanned aircraft to provide ISR mission (Intelligence, Surveillance, and Reconnaissance), with cargo drop capability during flight. The multiplatform system consists of a few HAASTA aircrafts, controlled from one GCS to perform an advanced mission.

- Fan Drive Gear System for turbofan jet enginesfrom Pratt&Whitney Rzeszów, is a gearbox, that connects an engine’s low-pressure turbine to the front fan.

- Power Transmissions Systems from Safran Transmission Systems Poland.

Parts and subassemblies for landing gear for civil and military aircraft from Collins Aerospace.

Why collaborate with Polish space and aviation companies?

- Technologies tested during NATO exercises

- High innovation and flexibility – Polish SMEs implement modern technologies tailored to specific customer needs

- Strategic location and NATO membership – Poland is a regional logistics and technology hub with direct access to EU and transatlantic markets

- Effective integration of civil and military technologies – Polish companies combine both worlds, enhancing commercial and operational potential (e.g., SAR sensors, launch systems)

- Highly qualified technical and engineering staff – Poland has experts with experience in space, defense, cybersecurity, electronics, and advanced technology design and implementation.

International Presence

From 2024 to 2029, the Polish Investment and Trade Agency will implement a promotional programme for high-tech space sectors. This initiative forms part of the ‘SME Internationalisation – Brand HUB’ project, which is funded by the EU through the European Funds for a Modern Economy (2021–2027).

The programme aims to promote Polish space technologies dynamically in key international markets by showcasing Polish companies, establishing B2B contacts and building Poland’s reputation as a producer of innovative solutions and an advanced space service provider.

The program focuses on supporting SMEs seeking foreign trade, technology, and investment partners. Promotional activities include:

- Trade missions for Polish entrepreneurs to foreign markets to establish business cooperation

- National pavilions at major international trade fairs

National Pavilions at Strategic Global Events

- ILA Berlin Air Show (Germany) 2026 – ILA Berlin

- Space Tech Expo, Bremen (Germany) 2026 – Space Tech Expo Europe

- Space Symposium, Colorado Springs (USA) 2027 – Space Symposium

- Paris Air Show (France) 2027 & 2029 – SIAE

- Space BR Show, São Paulo (Brazil) 2028 – Space BR Show

Contact

Want to Learn More About Events?

Contact space sector coordinator:

Contact aviation space sector coordinator

Want More Information About the Sector?

Visit:

A publication on the space and aerospace sector in Poland is being prepared — expected release: Q1 2026.

Supervising institution

Polish Space Agency

- Tel.: +48 58 500 87 60

- E-mail: sekretariat@polsa.gov.pl

Spis treściTable of contents